House Select Committee on Oversight and Reform Co-Chairs Jake Johnson (R-Polk), Harry Warren (R-Rowan), and Brenden Jones (R-Columbus) sent letters to officials from the City of Charlotte and Mecklenburg County requesting documents, communication, and data concerning crime and public safety.

The letters, sent to Charlotte Mayor Vi Lyles, Charlotte City Manager Marcus Jones, Charlotte-Mecklenburg Police Chief Estella Patterson, Mecklenburg County Sheriff Garry McFadden, Mecklenburg County Manager Mike Bryant, Mecklenburg County District Attorney Spencer Merriweather, and Charlotte Area Transit System Interim CEO Brent Cagle, can be found on the committee’s website.

Members of the House Select Committee on Oversight and Reform questioned the trajectory of the support awarded by North Carolina IOLTA (Interest on Lawyers’ Trust Accounts) during Wednesday’s hearing with North Carolina Bar Association Executive Director Peter Bolac and NC IOLTA Executive Director Mary Irvine.

Co-Chair Rep. Harry Warren (R-Rowan) explained what IOLTA is for those who were unfamiliar:

“The State Bar and Supreme Court created NC IOLTA in 1983 to distribute interest earned on income from lawyers’ general trust accounts to fund legal services and other programs for the public’s benefit. When a client hires a lawyer, retainer fees, settlement fees, and upfront payments are put into a trust account for later distribution to the appropriate parties. Although the accounts earn interest, attorneys cannot ethically claim the interest, therefore, North Carolina and every other state have created a version of IOLTA to help with access to civil courts.” NC IOLTA’s grant funding jumped from a fairly consistent $1.6 million through the 2010s to $3.4 million in 2020 and continued to balloon to $12.1 million in 2025.

“At its simplest,” Warren said, “IOLTA uses that interest to help those who couldn’t afford legal services.”

Bolac and Irvine agreed that NC IOLTA funding is, in Bolac’s words, “for the provision of legal services to be available for all North Carolinians regardless of ability to pay.”

Several members emphasized the importance of IOLTA’s civil legal aid while raising questions about how it distributed the money, the recipients, and whether it was an appropriate source of funds in the first place. The General Assembly included a provision in SB429 to freeze IOLTA grants through June 2026 due to questionable organizations and grants.

“I have no problems with the goals of this program,” Rep. Grant Campbell (R-Cabarrus) said. “I’ve looked at eligibility requirements. I’ve seen many examples of positive impacts.” Campbell continued, “I’m not a throw-the-baby-out-with-the-bathwater kind of guy, but we have found some examples where maybe the purpose of this program has lost its way.”

“We found some examples where maybe the purpose of this program has lost its way.”

Rep. Grant Campbell

Campbell cited the Amica Center for Immigrant Rights, based in Washington, D.C., which explains on its “Becoming an Anti-Racist Organization” page: “The United States’ wealth and power is built on stolen land, from enslaved labor, and under the racist lie that White people were superior to Black people, Indigenous people, and people of color.”

Warren, in his opening remarks, noted that the Children’s Law Center of Central North Carolina aims to dismantle the “systems of oppression…that don’t support equitable outcomes.”

Irvine agreed that grants should not be used to fund political activism. Members wondered how IOLTA could police the use of funds. Rep. Mike Schietzelt (R-Wake) said, “It begins to matter when you fund organizations that engage in political activity, because it frees up resources to use for political activity.”

Bolac suggested IOLTA could stop funding organizations that engage in any political activity beyond legal aid.

Irvine told Rep. Allen Chesser (R-Nash) that only “a couple of times” has the NC IOLTA board pulled back funding from grantees who did not meet their grant commitments.

In response to member concerns about rural counties being excluded, Irvine said, “We’ve made a concerted effort to try to make sure that funds are getting to rural communities including by launching a relatively new project to support law students who are working in more rural communities.”

The dual nature of the State Bar and the unusual status of IOLTA funds raised additional questions. Bolac agreed with members that, although the State Bar is subject to the Administrative Office of the Courts in its administration of attorneys, its funding and existence are subject to the General Assembly.

“As we looked into it, we wondered, ‘Whose money is it anyway?’” Warren said. “Does the interest earned belong to the client? Should the money be considered part of the General Fund to be appropriated by the General Assembly?”

Co-chair Warren left open the possibility of another hearing with NC IOLTA to give members time for additional questions.

The House Select Committee on Oversight and Reform will hold a hearing October 22 at 9 a.m.

The committee will hear testimony from North Carolina Bar Association Executive Director Peter Bolac and Mary Irvine, executive director of North Carolina IOLTA (Interest on Lawyers’ Trust Accounts).

IOLTA exists to support those who provide legal services to the indigent and programs that improve the administration of justice. Its funding comes from the interest earned on the accounts where retainer fees, settlement fees, and other advance payments are held. Committee members will investigate NC IOLTA’s funding, the composition of its board, and the pattern of awarding grants to left-leaning organizations.

In June, the General Assembly passed SB429 freezing the group’s ability to make grants while members learn more.

Co-Chair Harry Warren (R-Rowan) said, “IOLTA was created in good faith to help those who need help with the justice system, but over the years, it seems to have become a boondoggle for woke causes that try to thwart the General Assembly’s work. We look forward to hearing IOLTA officials explain their decisions.”

The House Oversight Committee held its third hearing to reset expectations of state agencies on April 3 with Treasurer Brad Briner and Secretary of State Elaine Marshall.

Treasurer: Briner seeks better investment returns and lower health care costs

Briner told members of the committee that the Department of the State Treasurer’s primary responsibility is to “manage the balance sheet of the state,” managing “the state’s assets and liabilities.” He cited the state’s AAA bond rating as a sign of success, just as the budget director and the controller did in their earlier appearances before the committee.

Pension investment management and the State Health Plan stood out as two areas where the Treasurer has been falling short. Briner said he aims to hit the target 6.5% annual return for pension investments. If the fund had managed that in recent years, he said, it would have eliminated the pension system’s $16 billion unfunded liability. He added that the state should be at least average among state pension plans.

The State Health Plan should deliver health care outcomes that are valued that the state can afford. “We’re not doing that right now.” As a result, State Health Plan could have $507 million deficit in 2026.

He reported that the unclaimed property division exceeded its goal of sending out more than $100 million a year and hopes a 12-week partnership with OpenAI will help find the rightful owners of more unclaimed funds.

Members had questions for Briner on his modernization proposal including the plan to move from sole fiduciary to an investment committee with appointments from the governor and legislative leaders along with the Treasurer himself. The modernization plan would also allow investments in cryptocurrencies and more flexibility across asset classes.

Briner pushed back on a suggestion that the state has room to borrow more noting the unfunded liabilities for the retiree health benefits and pensions bring the total obligation of the state to $52 billion.

On a more positive note, Rep. Dean Arp (R-Union) and Briner highlighted the state’s reduction in bonded debt over the past 13 years from $6 billion to $2 billion. Rep. Tim Reeder (R-Pitt) asked Briner for details on pilot programs to encourage state employees on the State Health Plan to seek low-cost care.

Secretary of State: Responsible for records

The Secretary of State’s office is where businesses and charities go to register, renew, and file annual reports. It’s where lobbyists and notaries do the same. The office also registers securities, land records, and advance health care directives. Marshall said the General Assembly has entrusted her office with such a wide variety because “we’re pretty good database managers.”

Members asked Marshall about areas that fall under the Secretary of State that are obsolete and could be statutorily removed, including the membership campgrounds, phone sales registration and bonding, cable television, franchises. While not weighing in on the value of legislation, Marshall noted that there are only a handful invention developers registered in the state.

In an otherwise cordial session, Marshall’s statement that a lack of space led to staff working in remote or hybrid roles drew a skeptical response. She also indicated that working remotely is a quiet way to provide people by allowing them to cut commuting cost. Marshall’s comment about productivity of remote workers suggested that some of them are in the agency’s call center. Members are seeking more details.

The House Oversight Committee will hold its third hearing in a series asking fundamental questions of agency secretaries and directors April 3 at 9 a.m.

The committee will hear first from Treasurer Brad Briner, then Secretary of State Elaine Marshall.

Co-Chair Harry Warren (R-Rowan) said, “Our members set the stage for this hearing series with thoughtful questions in the first two meetings. We look forward to carrying those through to each agency, giving us the opportunity to reset how we think about agencies and what they do.”

With a new gubernatorial administration comes the opportunity to take a fresh look at state agencies, why they exist, and what they do. Over the coming months, the House Oversight Committee will call on agency secretaries and directors to answer the question: “Does the agency make life in North Carolina better?”

The committee will hold a set of hearings in its February 27 meeting. At 10:30 a.m., Secretary-designee of Revenue McKinley Wooten, Jr., State Controller Nels Roseland, State Budget Director Kristin Walker, and Treasurer Brad Briner will explain what their agencies do and how they can help with accountability measures for others.

Department of Transportation Secretary Joey Hopkins and DMV Commissioner Wayne Goodwin will begin their testimony at 1:00 p.m.

“Government efficiency starts with defining the job of government in practical terms,” Co-Chair Brenden Jones (R-Columbus) said.

Co-Chair Jake Johnson (R-Polk) added, “It’s a fair question to ask every agency: How do we know our spending on an agency has any impact, good or bad, on the people of North Carolina?”

“Government should exist for the people,” Co-Chair Harry Warren (R-Rowan) said. “Our committee members want to assess where things stand and what can be accomplished.”

NCInnovation provided its 2024 audit to General Assembly on November 21. You can find the audit here and an Excel spreadsheet of the financials here. Of note in the cover letter from independent auditor BDO is the acknowledgement that NCInnovation did not have an independent audit before receiving its first $250 million in state funds:

The 2023 financial statements of the Organization were reviewed by other auditors, whose report dated January 10, 2024[,] stated that they were not aware of any material modifications that should be made to those statements for them to be in accordance with accounting principles generally accepted in the United States of America. A review is substantially less in scope than an audit and does not provide a basis for the expression of an opinion on the financial statements as a whole. [emphasis added]

NC Gen. Stat. 143-728(d)(9) requires NCI to “maintain separate accounting records for and separate accounts [for State and private funds] and shall not commingle [the two],” but the audited financial statements do not make clear the separation of public and private funds. Despite this, it appears that grants are the only thing currently being paid from state funds. This is the largest expense for NCI as projects in the pilot round of grants qualify for their second tranche of funding and as NCI completes its first statewide round of grantmaking in early 2025. The Request for Proposals page states, “The deadline for the fall 2024 pre-application is Friday, December 13, 2024. Applicants can anticipate hearing a response from NCI within one to two months from the application deadline.”

The second largest expense for NCI is salaries and benefits, totaling $2.6 million for the fiscal year. Because the regional hub personnel did not start until November, the annualized expense is more than $3.0 million.

NCInnovation FY2024 Audited Financial Statements and Report [PDF]

Annotated NCInnovation FY2024 Audited Financial Statements [Excel]

The House Oversight and Reform Select Committee has called NCInnovation (NCI) CEO Bennet Waters to testify before the committee Tuesday, July 9, at 9 a.m. in the Legislative Building’s Blue Ridge Auditorium.

NCI is a public-private partnership intended to speed commercialization of university research. After proposals to fund NCI from the earnings of a $1.425 billion endowment, the final 2023 budget bill (HB 259, SL 2023-134) included two appropriations to the endowment of $250 million each.

“The General Assembly made a big bet on NCInnovation. If it succeeds in bringing university research to market, the state will reap significant returns,” said co-chair Rep. Harry Warren (R-Rowan). “NCI leadership has not publicly addressed its funding assumptions or its operations. This hearing can be a step to increase our comfort with putting so much faith in one organization’s ability to pick winning technologies.”

Committee members have questions on NCI’s legislative reporting, receipt and use of state funds, its operations and grantmaking, its funding assumptions, and its long-term plans.

Co-chair Rep. Jake Johnson (R-Polk) noted, “NCInnovation intentionally chose two projects from each region, which does raise concerns of how much it is making decisions on merit and how much on political considerations.”

A hearing that began with conflicting stories between the Department of Motor Vehicles and a vendor ended with questions of DMV’s compliance with state law. Along the way, members had many questions for DMV Commissioner Wayne Goodwin and Idemia North America Vice President for Global Corporate Relations Lisa Shoemaker during the Thursday, June 6 House Oversight and Reform hearing.

From 6:45 on February 15 to 5:45 on February 20, DMV software improperly allowed 2,136 customers to renew their licenses. By the time DMV recognized the problem, its vendor Idemia had already printed many of the requested licenses. Idemia and DMV blamed each other for the eventual decision to find and retrieve the problem cards from among 33,000 printed at the same time. Idemia halted production to conduct the search and did not resume until March 4. Over the next few weeks, the backlog from missed production days and high demand for IDs grew to more than 350,000. Some people were waiting two months to receive their credentials.

Although DMV and Idemia disputed each other’s interpretations of events, both agreed that Idemia will be back on track by June 30. In addition to the 10,000 daily units Idemia produces in Sacramento, California, the company expanded production to its Springfield, Illinois, plant on May 13.

Committee members targeted their questions on the legality of this decision. Chair Harry Warren (R-Rowan) cited Commissioner Goodwin’s May 6 letter to all members of the General Assembly. “As you know,” Goodwin wrote, “the Division of Motor Vehicles (“DMV”) is required to have all credentials produced and issued from a central location. N.C. GEN. STAT. § 20-1(c1)(5) [N.C. GEN. STAT.§207-(f)(5)].”

At the hearing, DMV debated the meaning of “central location” while also acknowledging that the law should be changed to accommodate the transition between two vendors. Chairman Warren asked Commissioner Goodwin whether he had asked for a change in the law, recognizing the challenges it presents. Rep. George Cleveland (R-Onslow) also raised concerns about DMV’s willingness to solve one problem by selectively interpreting the law. Goodwin argued that central location could mean “one company.” Cleveland responded, “When Idemia opened another facility, they broke our state law, and you, I understand, did nothing about this.”

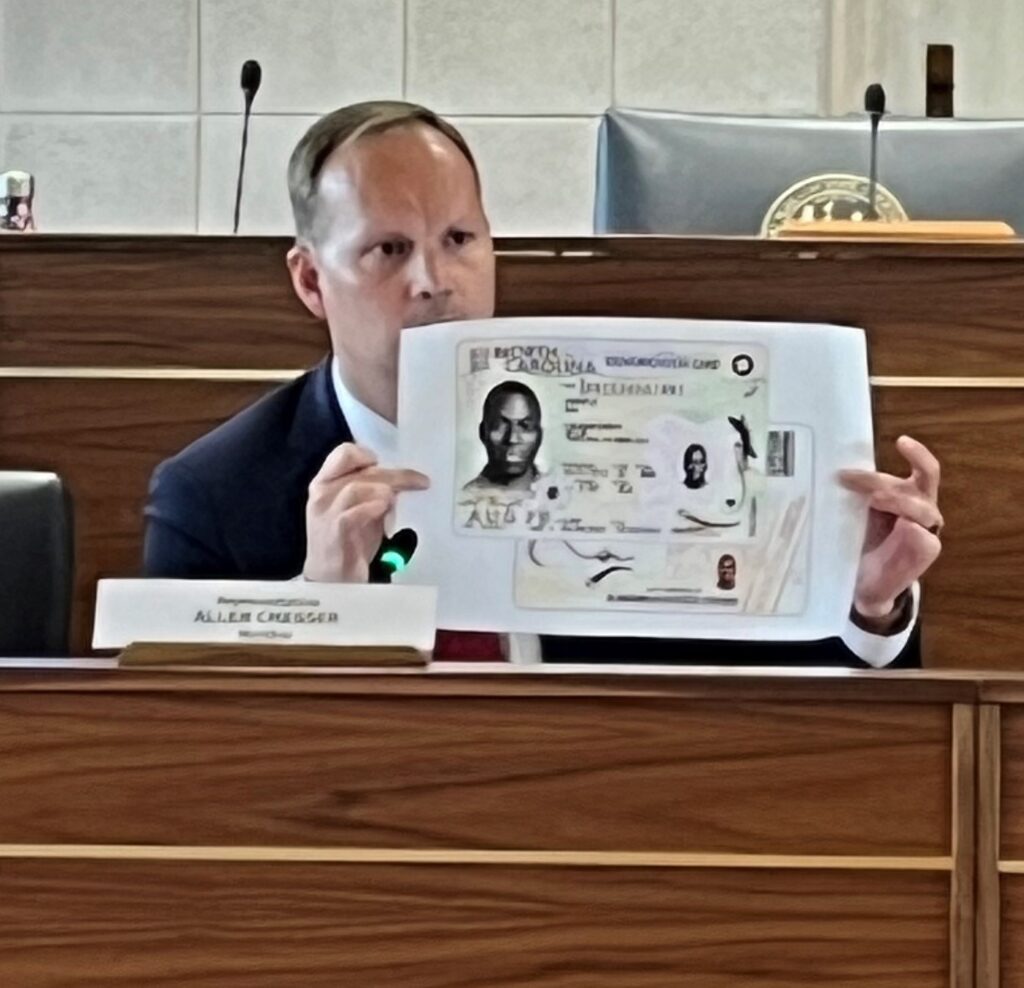

Rep. Allen Chesser (R-Nash) joined Cleveland and Warren in questioning DMV’s interpretation of state law. Chesser asked about DMV’s contracting exemption under HB650 (SL 2021-134) and its willingness to sign a contract for driver’s license production that conflicted with General Statute §20-7(n)(4) which specifies a physical license must include a color photo. Counsel Drew Marsh wrote in his April 12 response to chairs of the Joint Legislative Transportation Oversight Committee, “…DMV had a good faith belief at the time prior to and shortly after entering the contract that the State might be amenable to amending that statute, if in fact it was necessary.”

Chesser held up a poster showing what the updated driver’s license will look like. The license includes a small color photo on the back that required purchase of $3 million in additional equipment and led to a 13% increase in price per card to $2.91 from the originally contracted price of $2.55 per card.

Although DMV’s contract with Idemia and its predecessors dated back to 1996, Goodwin said, “It was our understanding that the legislature had changed the law previously whenever there was a change with contractors.”

“Changing the law at a previous date doesn’t mean you were in compliance with the current law,” Chesser responded.

With the disputes over the meaning of “central location,” the need for a color photograph on driver’s licenses, and DMV’s exemption from Department of Information Technology contracting procedures and oversight, Chairman Warren summed up his frustration: “The department sems to have a pattern of interpreting statute as it best fits your need.”

Idemia has sued DMV over its contract award to Canadian Bank Note Secure Technology, Inc. (CBN-STI). Any judgment in the lawsuit could affect DMV’s ability to use the exemption. The transition to CBN should be complete by July 1, and with the backlog resolved, will settle for now the color photo requirement and the definition of “central location.” DMV has added another series of projects to replace its core systems for driver’s licenses and vehicle titles under the HB650 exemption, so that controversy will continue as will the possible need to amend state law.

While DMV was the focus of the hearing, members complained that other agencies have taken similar liberties with the law. “If you want to circumvent the law, counsel is a good way to go.… I see that being done. Not only in your organization, I see it in other agencies that I have the pleasure of overseeing, and it’s something that really needs to stop,” Cleveland said.

Raleigh, NC – The House Oversight and Reform Committee has requested Department of Motor Vehicles Commissioner Wayne Goodwin to appear before the committee Thursday, June 6, at 9 a.m. in the Legislative Building Auditorium.

Members of the committee will be seeking answers on problems old and new. Goodwin is expected to address the backlog of delivery of driver’s licenses and state IDs and report on the implementation of kiosks. Members will also question the commissioner on the transition to a new vendor for credentials, expectations for the summer DMV office rush, and the status of license plate agencies.

“Drivers have enough frustrations dealing with the DMV without additional delays in getting their licenses. I expect Commissioner Goodwin will be able to explain the reason for the delay and what measures the DMV is taking to fix this latest problem quickly,” co-chair Harry Warren (R-Rowan) said.

Members will also be following up on questions from last year’s House Oversight hearing and a February meeting of the Joint Legislative Transportation Oversight Committee.

“DMV deserves scrutiny,” said co-chair Jake Johnson(R-Polk). “It is one of the most conspicuous services of state government, so it should set the bar for customer service. We know its problems and I hope Commissioner Goodwin will be able to tell us about its progress.”