Video here.

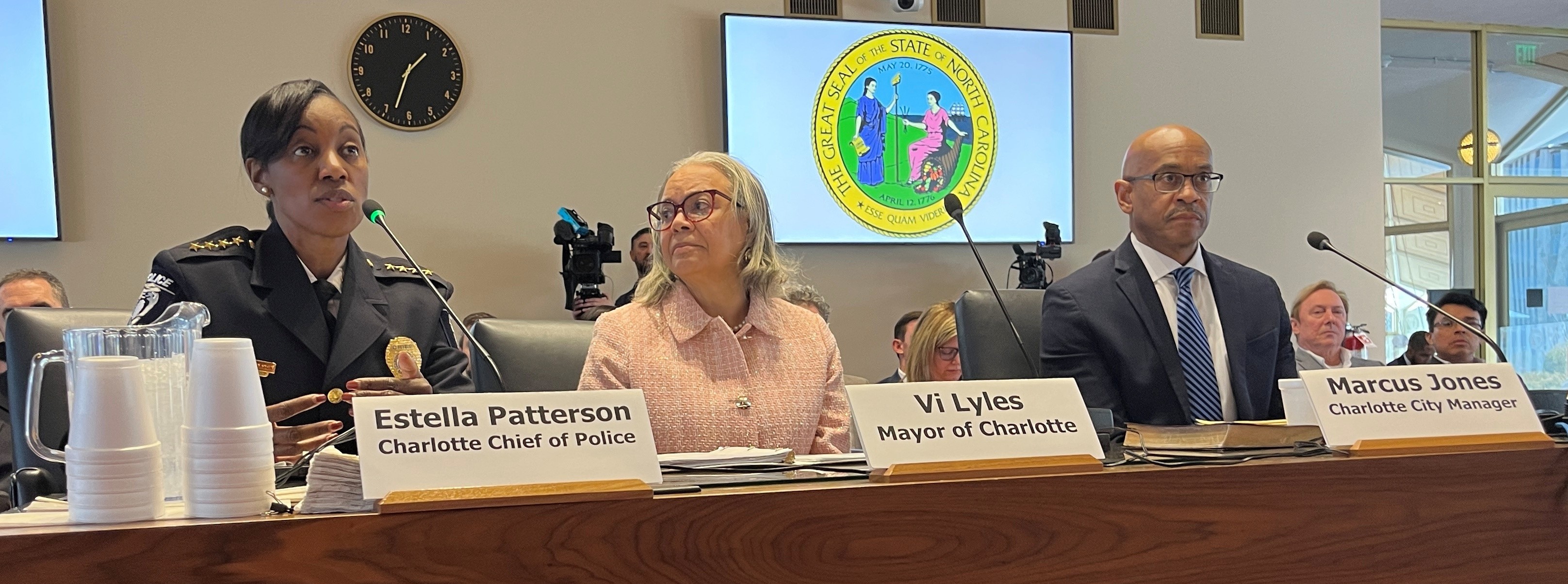

Mecklenburg County Sheriff Garry McFadden and other officials from Mecklenburg County and the City of Charlotte testified before the House Select Committee on Oversight and Reform on February 9. The planned topic was public safety, with concerns about immigration enforcement, mental health, public transit, and funding priorities

McFadden called himself the “elephant in the room” and lived up to that with long answers that bordered on lecturing committee members. The morning session with him and District Attorney Spencer Merriweather ran more than three hours, with most of that time dedicated to combative exchanges with the sheriff.

In contrast, the afternoon session with Charlotte-Mecklenburg Police Department Chief Estella Patterson, Mayor Vi Lyles, and City Manager Marcus Jones lasted just 80 combat-free minutes.

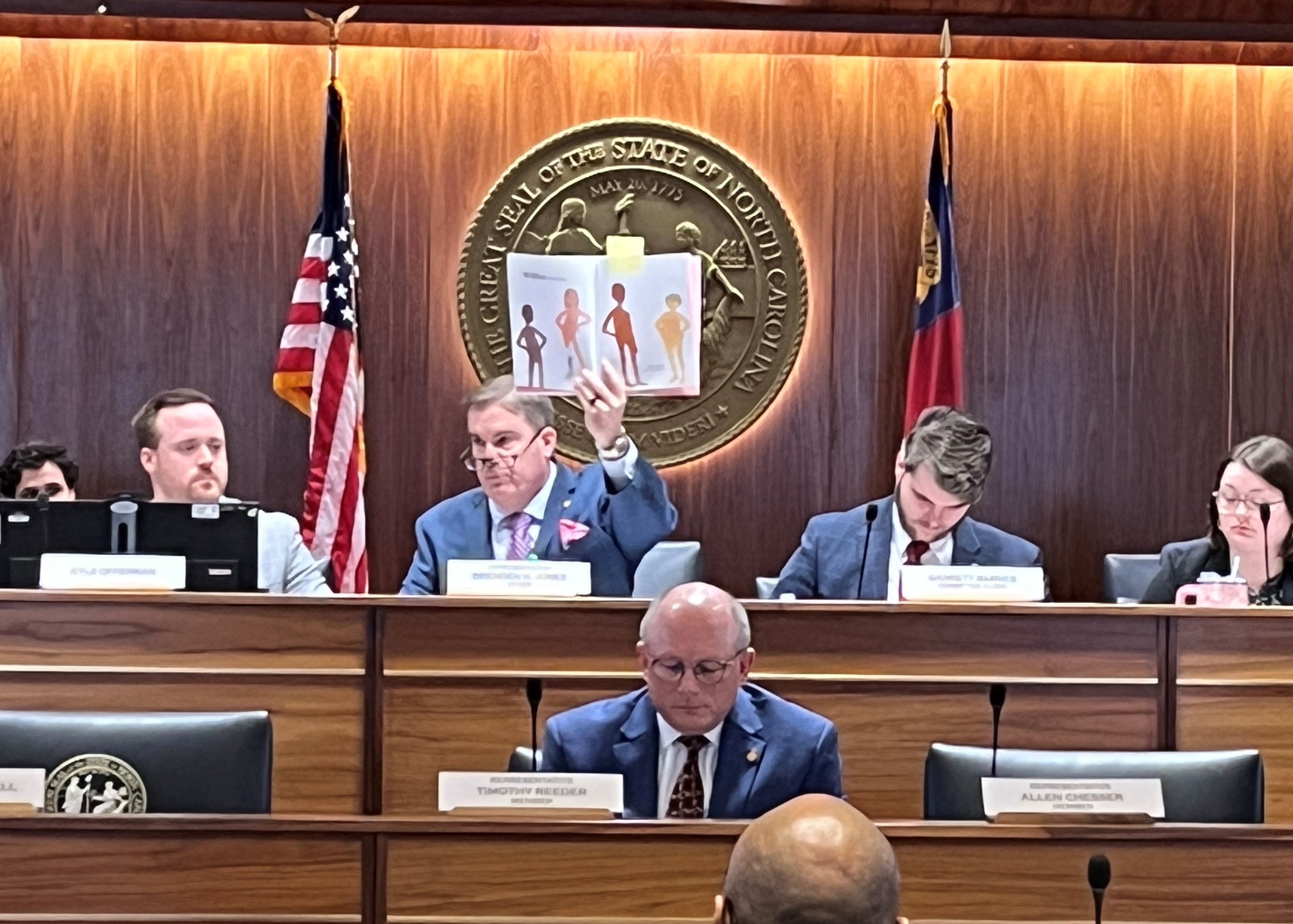

McFadden often said he could not answer questions due to ongoing litigation and an SBI investigation. Frustrated, Chairman Brenden Jones (R-Columbus) called a recess for McFadden to confer with his attorneys about what he could say.

Other than an impromptu civics lesson from Rep. Allen Chesser (R-Nash) that has gained national attention, members asked about safety in the county jail, work culture in the sheriff’s office, and detaining inmates for Immigration and Customs Enforcement (ICE).

McFadden said he still thinks Iryna’s Law is “a mistake” and that it has done “no good,” told the committee he was speaking specifically about Mecklenburg County. DA Merriweather called the legislation a “good thing.”

Asked why ICE picked up just 16% of Mecklenburg County inmates with a detainer in 2025 but picked up 65% of Wake County inmates, McFadden instead complained that state legislators did not seek his expertise before writing or passing the relevant laws.

Co-Chair Jake Johnson (R-Polk) explained to McFadden that being the only sheriff called to testify to the Committee “is not a point of pride.” Johnson added, “There are clearly problems within the department that we’re going to have to address going forward.”

CMPD Chief Patterson described her plan to improve policing in Charlotte, including youth and mental health efforts. Rep. Brian Echevarria (R-Cabarrus) asked how the city could spend $100 million on diversity but not direct any of that to safety when 60% of violent crime victims are black.

Jones told Charlotte officials he wanted them to make national headlines for positive things, not for the not the things that have dominated the news cycle in recent months.

“I want Charlotte making national news for the World Military Games [next summer],” Rep. Jones concluded. “I want that city to be the shining gem of North Carolina that I know it can be.”

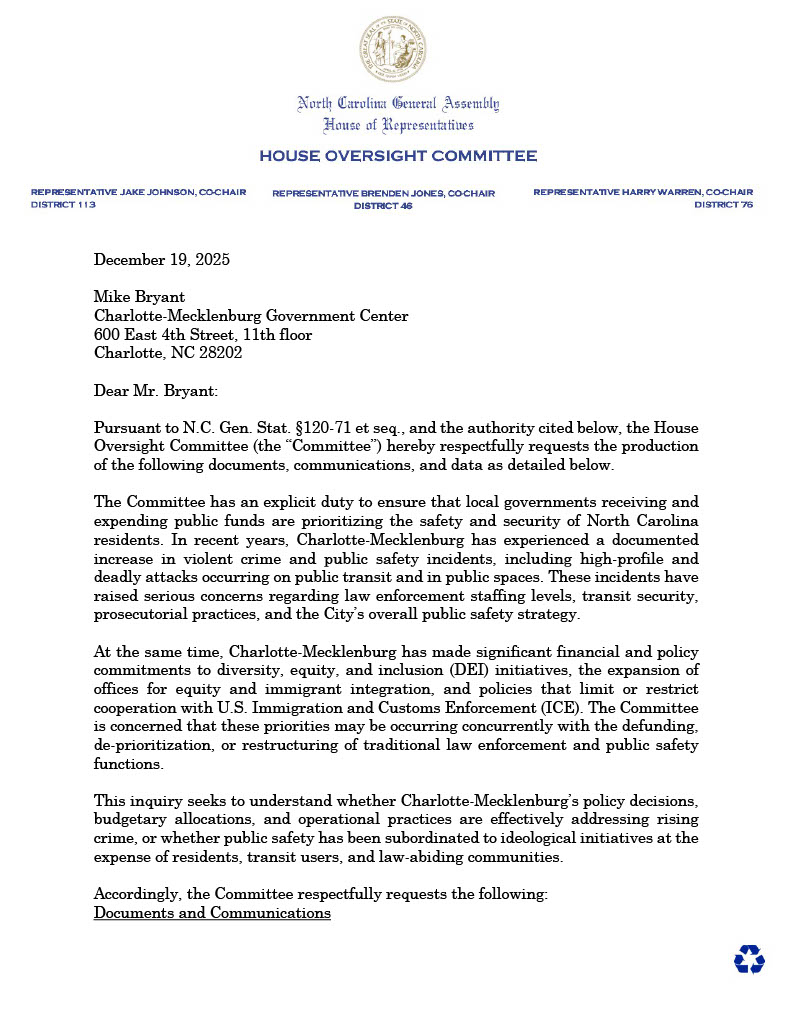

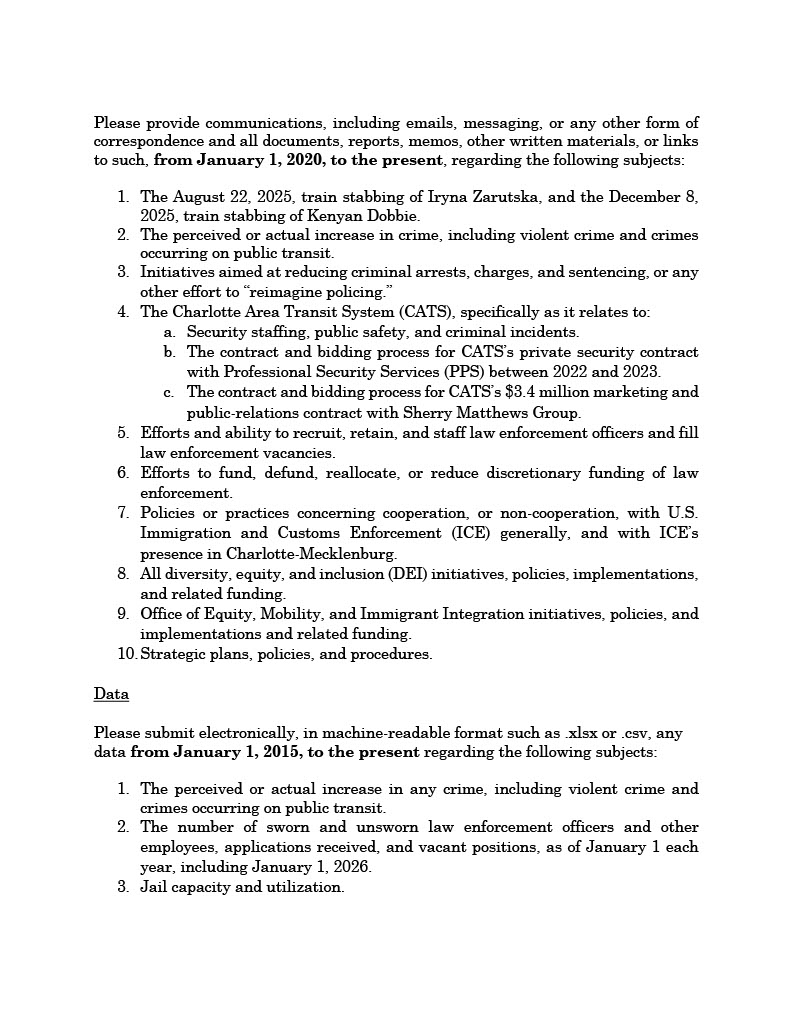

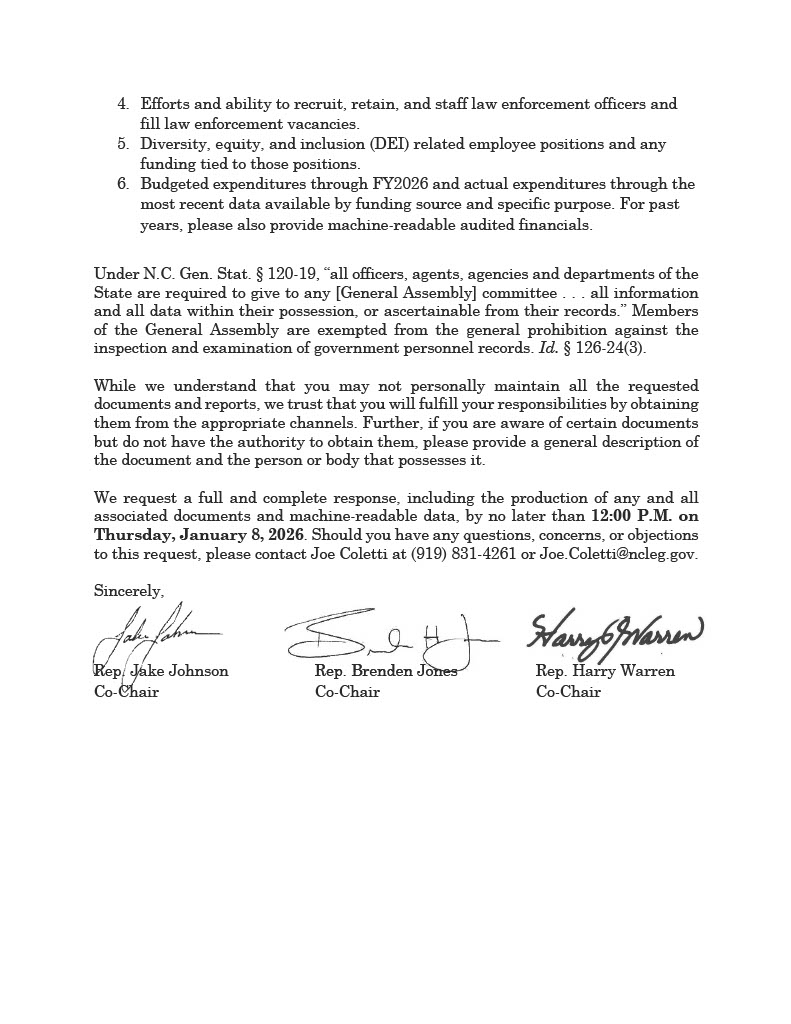

House Select Committee on Oversight and Reform Co-Chairs Jake Johnson (R-Polk), Harry Warren (R-Rowan), and Brenden Jones (R-Columbus) sent letters to officials from the City of Charlotte and Mecklenburg County requesting documents, communication, and data concerning crime and public safety.

The letters, sent to Charlotte Mayor Vi Lyles, Charlotte City Manager Marcus Jones, Charlotte-Mecklenburg Police Chief Estella Patterson, Mecklenburg County Sheriff Garry McFadden, Mecklenburg County Manager Mike Bryant, Mecklenburg County District Attorney Spencer Merriweather, and Charlotte Area Transit System Interim CEO Brent Cagle, can be found on the committee’s website.

Rep. Brenden Jones (R-Columbus) and other members of the House Select Committee on Oversight and Reform pressed Chapel Hill-Carrboro City Schools (CHCCS) officials on the district’s defiance of state law, promoted resources, educational performance, enrollment, and finances during a contentious hearing on December 10.

Co-Chair Jones warned from the outset that the hearing would be uncomfortable. He told CHCCS Board Chair George Griffin and Superintendent Rodney Trice: “You are here today because you chose to wage war against the law. You chose to deceive the public, and now you are here because you got caught.”

The committee called Griffin and Trice to testify after a video in October showed Griffin bragging that CHCCS “was the only school district in North Carolina…that stood up to the General Assembly” on SB 49, The Parents’ Bill of Rights. The bill became law in August 2023 when the General Assembly overrode Gov. Roy Cooper’s veto. In January 2024, the school board voted unanimously to disregard two provisions of the law: a requirement to notify parents before changing their student’s name or gender, and a prohibition on sex and gender curriculum for children in grades kindergarten through fourth.

Despite repeated assurances to committee members that the district was complying with the law, Griffin eventually acknowledged that he thought the law conflicted with federal anti-discrimination law.

Jones held up three books on a list linked from the equity office’s resources page that could introduce young children to topics that should not be in the curriculum for young students under SB 49.

Trice said he was not familiar with the books or the link, but he said a rogue employee could not have posted the link without approval: “We have a multidisciplinary team that reviews materials or resources, particularly if those resources are going to be shared with parents.”

Chapel Hill-Carrboro Schools has a reputation as one of the best school districts in the state, and Trice said, “Certainly I would put the success of our students squarely to our parents. They’re very involved with the education and the direction of our school district. They demand high quality curricula, strong instructional approaches in the classroom. And beyond that, I would put our teachers up against any teachers in North Carolina or across the country for that matter.”

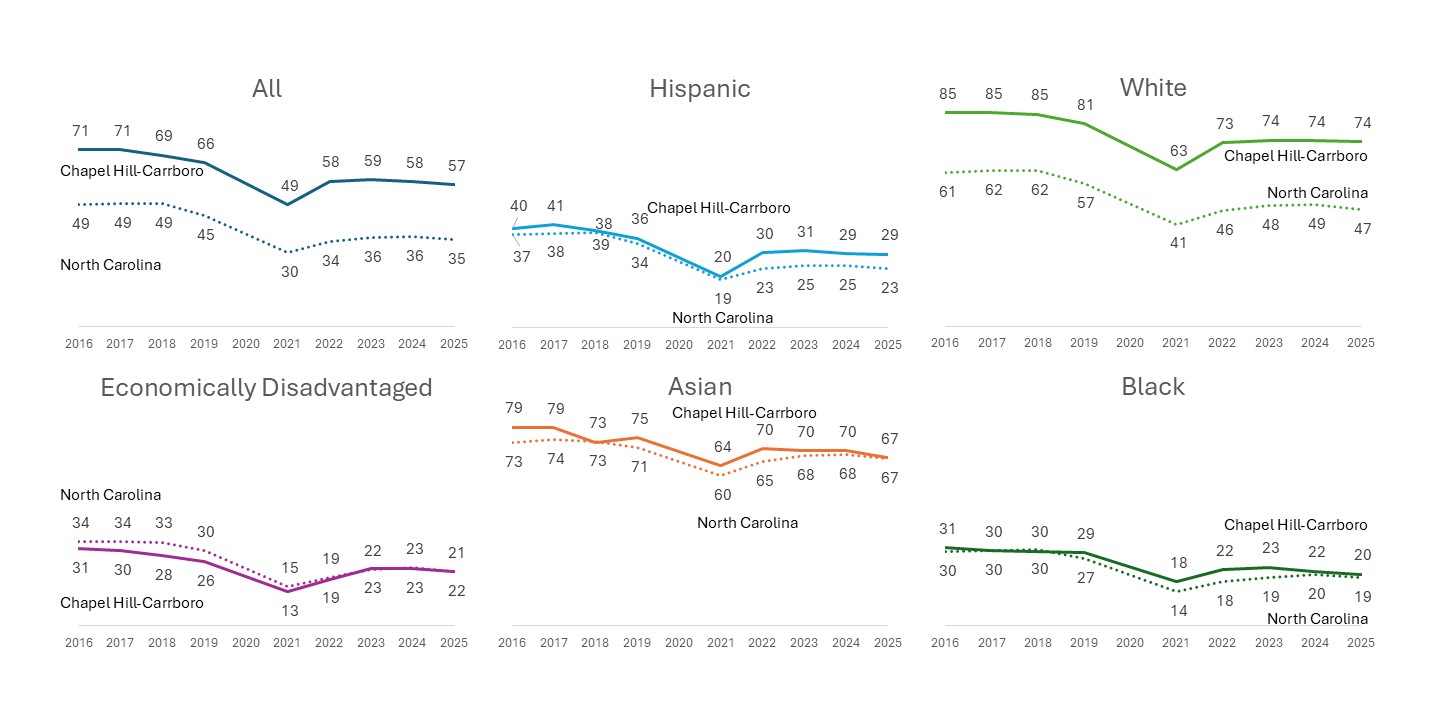

He was defensive of the district’s performance, but he did admit, “We struggled like many districts with closing opportunity gaps and achievement gaps in our district.” Committee staff analysis of state standardized testing found black, Hispanic, and economically disadvantaged students performed comparably to their peers in other school districts, and well below Asian and white students in CHCCS. White students were the only racial or ethnic group in CHCCS to outperform the state average for that group. [see graphs below]

“For the better part of a decade,” Trice said, “we’ve seen … declining enrollment,” which he called the district’s “biggest challenge” because enrollment is “one of the primary ways that school districts across North Carolina receive funding to educate their kids.” Rep. Charles Miller (R-Brunswick, New Hanover) was among those who questioned the district’s financial situation considering the district’s shrinking enrollment.

Rep. Mike Schietzelt (R-Wake) put the district’s enrollment and financial challenges in context with the legislature’s budget fight: “There’s a lot of mounting distrust with the public school districts as reflected by the declining enrollment right now.” Noting that the House budget included a significant raise for teachers, he added, “We care about the teachers because we care about the kids, and it makes it really difficult for us to do our job when the leaders of these school districts can’t come in here and even give us a straightforward answer to straightforward questions.”

“What you’re doing is wrong, and you lied to this committee under oath,” Jones emphasized. “You’ve replaced reading, math, and science with guilt, shame, and division. You’re teaching kids to feel guilty, either oppressed based on color of their skin, their family values, or what they believe. And while performing gaps grow wider and test scores fall off a cliff, you focused on one thing, spreading your ideology.”

“Let me be real clear,” he said in conclusion, “This General Assembly will use every tool, every statute, and every ounce of our authority to protect children and to force you to comply with the law. If you don’t follow it willingly, we will hold you to the fire with every legal and legislative mechanism in our power. You’ve made your choice, and we’ve made ours.”

The House Select Committee on Oversight and Reform will hold a hearing December 10 at 9 a.m.

The committee will hear testimony from Chapel Hill-Carrboro City Schools (CHCCS) Board of Education Chair George Griffin and Superintendent Rodney Trice.

CHCCS came under scrutiny in October when a clip surfaced online of Griffin bragging that CHCCS was openly defying SB49, The Parents’ Bill of Rights. The bill became law in August 2023 when the General Assembly overrode Gov. Roy Cooper’s veto. The school board voted unanimously to refuse to develop policies that would notify parents when the school changed a student’s name or gender and keep gender identity, sexual activity, and sexuality out of the curriculum for children from kindergarten through fourth grade.

School board Chairman George Griffin in a video clip called it “ludicrous” to “wordsmith policies that legitimized discrimination.” Griffin added that CHCCS was “the only school district in North Carolina of 115 school districts that stood up to the General Assembly and said, ‘We’re not doing this.’”

Despite the strong language on video, Griffin’s written testimony states, “To my knowledge, Chapel Hill-Carrboro City Schools has always been, and continues to be, in compliance with the law-including the Parents Bill of Rights.” Superintendent Trice similarly states, “To my knowledge, the District has always complied with this law.” Other documents provided by the district, suggest some there may be some wordsmithing involved in reaching this conclusion.

Both written testimonies also tout the district’s academic performance and commitment to non-discrimination. Again, actions speak louder than words as black and Hispanic students perform near the same level as their peers across the state, reaching career and college ready status on end-of-year testing at less than half the rate of white students in the district.

“School systems funded by taxpayer dollars cannot run amok and make their own rules. Chapel-Hill Carrboro City Schools needs to focus on educating kids in science, reading, and math, rather than teaching them woke ideology.” Co-Chair Brenden Jones (R-Columbus) said.

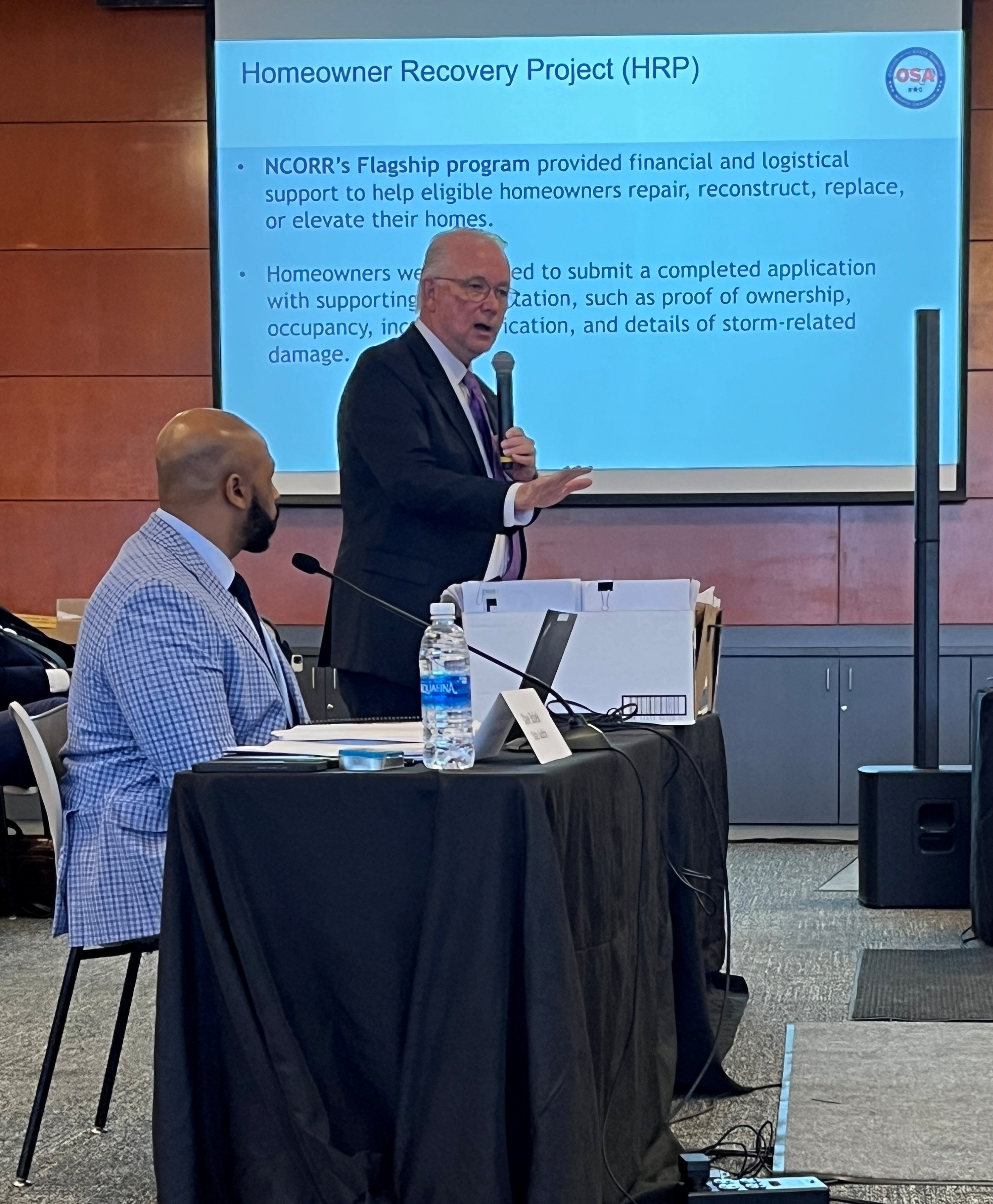

State Auditor Dave Boliek presented his report on the North Carolina Office of Recovery and Resiliency (NCORR) to the Joint Legislative Commission on Governmental Operations Subcommittee on Hurricane Response and Recovery on November 20. Hurricane Matthew in 2016 and Hurricane Florence in 2016, he said, “are two disasters, and quite frankly, the third disaster that this state has experienced is NCORR itself.”

Boliek detailed NCORR’s flaws to the subcommittee for two hours in a hearing at East Carolina University. Audit staff, according to Boliek, said NCORR had the worst accounting they had ever seen and that the program presented a logistical nightmare. He did, however, acknowledge that NCORR had fixed many of its procedural flaws beginning in 2022, particularly after Pryor Gibson stepped in last year. Coincidentally, legislative leadership formed the subcommittee in summer 2022.

NCORR Director Pryor Gibson said in his testimony, “There’s no question, there’s no excuses, there’s no sugarcoating the mess that was the first two or three years of NCORR.”

Created in 2018 to facilitate the repair and rebuilding of homes with federal Housing and Urban Development (HUD) funding, NCORR came under scrutiny from the General Assembly in 2022 when the program was completing fewer than 10 homes per month.

“Don’t take your foot off the gas.”

Rep. Karl Gillespie

As the subcommittee had heard in its five previous hearings: NCORR had problems managing its budget, data, and processes. NCORR received $982 million for disaster response and mitigation. The agency originally budgeted $534 million in grants for Matthew and Florence to the Homeowner Recovery Program (HRP). That amount eventually grew to $709 million before the General Assembly provided a $297 million bailout, bringing HRP alone to a sum greater than the federal money originally planned across all grant programs.

Subcommittee members questioned Boliek about the inconsistencies he documented across NCORR internal accounting, its reporting to the federal government through the Disaster Recovery Grant Reporting (DRGR) system, and the state’s consolidated accounting systems. One invoice had a 129% difference in the payment posted to each of the three systems.

Boliek and subcommittee members noted the marked improvement in outcomes once Gibson took over at NCORR. In turn, Gibson assured the subcommittee that all remaining projects would be underway before the end of the year and completed before October 2026.

Gibson shared that he has passed on the lessons he has learned from NCORR’s failures to the teams leading Hurricane Helene recovery efforts. Many of their processes so far correspond directly to the Auditor’s recommendations.

Co-chair Rep. Karl Gillespie (R-Macon) had one piece of advice for Gibson as NCORR works to get the final 328 families back home: “Don’t take your foot off the gas, and let’s get this thing done.”

Members of the House Select Committee on Oversight and Reform questioned the trajectory of the support awarded by North Carolina IOLTA (Interest on Lawyers’ Trust Accounts) during Wednesday’s hearing with North Carolina Bar Association Executive Director Peter Bolac and NC IOLTA Executive Director Mary Irvine.

Co-Chair Rep. Harry Warren (R-Rowan) explained what IOLTA is for those who were unfamiliar:

“The State Bar and Supreme Court created NC IOLTA in 1983 to distribute interest earned on income from lawyers’ general trust accounts to fund legal services and other programs for the public’s benefit. When a client hires a lawyer, retainer fees, settlement fees, and upfront payments are put into a trust account for later distribution to the appropriate parties. Although the accounts earn interest, attorneys cannot ethically claim the interest, therefore, North Carolina and every other state have created a version of IOLTA to help with access to civil courts.” NC IOLTA’s grant funding jumped from a fairly consistent $1.6 million through the 2010s to $3.4 million in 2020 and continued to balloon to $12.1 million in 2025.

“At its simplest,” Warren said, “IOLTA uses that interest to help those who couldn’t afford legal services.”

Bolac and Irvine agreed that NC IOLTA funding is, in Bolac’s words, “for the provision of legal services to be available for all North Carolinians regardless of ability to pay.”

Several members emphasized the importance of IOLTA’s civil legal aid while raising questions about how it distributed the money, the recipients, and whether it was an appropriate source of funds in the first place. The General Assembly included a provision in SB429 to freeze IOLTA grants through June 2026 due to questionable organizations and grants.

“I have no problems with the goals of this program,” Rep. Grant Campbell (R-Cabarrus) said. “I’ve looked at eligibility requirements. I’ve seen many examples of positive impacts.” Campbell continued, “I’m not a throw-the-baby-out-with-the-bathwater kind of guy, but we have found some examples where maybe the purpose of this program has lost its way.”

“We found some examples where maybe the purpose of this program has lost its way.”

Rep. Grant Campbell

Campbell cited the Amica Center for Immigrant Rights, based in Washington, D.C., which explains on its “Becoming an Anti-Racist Organization” page: “The United States’ wealth and power is built on stolen land, from enslaved labor, and under the racist lie that White people were superior to Black people, Indigenous people, and people of color.”

Warren, in his opening remarks, noted that the Children’s Law Center of Central North Carolina aims to dismantle the “systems of oppression…that don’t support equitable outcomes.”

Irvine agreed that grants should not be used to fund political activism. Members wondered how IOLTA could police the use of funds. Rep. Mike Schietzelt (R-Wake) said, “It begins to matter when you fund organizations that engage in political activity, because it frees up resources to use for political activity.”

Bolac suggested IOLTA could stop funding organizations that engage in any political activity beyond legal aid.

Irvine told Rep. Allen Chesser (R-Nash) that only “a couple of times” has the NC IOLTA board pulled back funding from grantees who did not meet their grant commitments.

In response to member concerns about rural counties being excluded, Irvine said, “We’ve made a concerted effort to try to make sure that funds are getting to rural communities including by launching a relatively new project to support law students who are working in more rural communities.”

The dual nature of the State Bar and the unusual status of IOLTA funds raised additional questions. Bolac agreed with members that, although the State Bar is subject to the Administrative Office of the Courts in its administration of attorneys, its funding and existence are subject to the General Assembly.

“As we looked into it, we wondered, ‘Whose money is it anyway?’” Warren said. “Does the interest earned belong to the client? Should the money be considered part of the General Fund to be appropriated by the General Assembly?”

Co-chair Warren left open the possibility of another hearing with NC IOLTA to give members time for additional questions.

The House Select Committee on Oversight and Reform will hold a hearing October 22 at 9 a.m.

The committee will hear testimony from North Carolina Bar Association Executive Director Peter Bolac and Mary Irvine, executive director of North Carolina IOLTA (Interest on Lawyers’ Trust Accounts).

IOLTA exists to support those who provide legal services to the indigent and programs that improve the administration of justice. Its funding comes from the interest earned on the accounts where retainer fees, settlement fees, and other advance payments are held. Committee members will investigate NC IOLTA’s funding, the composition of its board, and the pattern of awarding grants to left-leaning organizations.

In June, the General Assembly passed SB429 freezing the group’s ability to make grants while members learn more.

Co-Chair Harry Warren (R-Rowan) said, “IOLTA was created in good faith to help those who need help with the justice system, but over the years, it seems to have become a boondoggle for woke causes that try to thwart the General Assembly’s work. We look forward to hearing IOLTA officials explain their decisions.”

Rep. Brenden Jones (R-Columbus) made clear the imperative to get relief to Western North Carolina in Wednesday’s Joint Legislative Commission on Governmental Operations Hurricane Response and Recovery Subcommittee hearing: “Don’t follow the Cooper playbook of excuses and delays. Move the money. Rebuild the homes. Report every dollar. This General Assembly will not allow another ‘Hurricane Cooper’ to drag on while families suffer.”

Jones asked pointedly, “Should we really, in the state, be in the housing business?” and instead rely on groups like Baptists on Mission “that can move way faster than state government.” Other members of the subcommittee echoed Jones’ sentiment as did representatives from Gov. Josh Stein’s administration and from local governments who testified to the committee.

Matt Calabria, director of the Governor’s Recovery Office for Western North Carolina (GROW NC), Stephanie McGarrah, deputy secretary at the Division of Community Revitalization (DCR), and Jonathan Krebs, Western North Carolina recovery advisor cited the $28 million for home and private road and bridge work the General Assembly had already appropriated to Baptist on Mission, Habitat for Humanity, and other volunteer organizations active in disaster (VOADs).

“Expanding on those missions will continue to demonstrate quick progress, but it’s very much dependent on state funds because the federal funds will not move that fast,” Krebs said.

Samaritan’s Purse and other privately funded volunteer organizations began swinging hammers and getting residents back in their homes just weeks after the storm. Luther Harrison, vice president of North American ministries for Samaritan’s Purse, said the organization had distributed 20,000 $250 gifts cards, made mortgage payments for families, delivered 17 mobile homes and 40 newly built homes, plus campers, cars, home repairs and furnishings. Harrison said not taking government money meant there was “no red tape, no restrictions, no reporting.”

In contrast, the state homeowner recovery program had repaired one home in early September, started work on a second home the day of the hearing, but was yet to begin construction on any new homes. McGarrah told the committee she hopes to have the first new-build completed in January.

Avery County Commissioner Dennis Aldridge and Yancey County Manager Lynn Austin told the committee that delayed reimbursements and changing-goalpost regulations are their biggest hurdles in recovery. They praised the $150 million cashflow loan program administered by State Treasurer Brad Briner.

Because the loans use state funds, Briner said his office could make the application simple and get the money out faster. “Time,” he explained, “is the biggest cost for everyone.”

On the anniversary of one of the deadliest, costliest natural disasters to hit North Carolina, Harrison said, “The grieving is still heavy in these communities.”

Rep. Jones, again, charged the governor’s team to not follow in Gov. Cooper’s “failed footsteps” and pledged the legislature’s commitment to Western North Carolina.

“To the families of Western North Carolina,” he concluded, “you are not forgotten. This General Assembly will stay in the fight until every home is rebuilt, every dollar is accounted for, and every promise is kept.”

“The folks in Western North Carolina, a lot of them, don’t care about what we’re talking about today. What they care about is help—seeing somebody pull up in the driveway, get out, put a nail apron on, and a hammer and go to work.”

Joint Legislative Commission on Governmental Operations Hurricane Response and Recovery Subcommittee Co-Chair Rep. Karl Gillespie (R-Macon) boiled down over an hour’s worth of questions and testimony to a desire for tangible progress.

North Carolina Emergency Management (NCEM) Director Will Ray and Governor’s Recovery Office for Western North Carolina (GROW NC) Director Matt Calabria described the progress on debris removal and the steps underway to begin repairing and replacing damaged homes. They both emphasized how complicated federal agencies make it to achieve results. Calabria repeated his frequent disclaimer on the pace of work: “We can never move fast enough.”

Ray explained the different options for debris removal and the cost sharing requirements.

Although some county managers had raised concerns with legislators about the process, Ray emphasized that counties have been free to choose the option that works best for them.

Rep. Jake Johnson (R-Polk) gave examples of one pile of debris being picked up while another directly beside it is classified differently and is not. He described the inefficiency of such situations and how they are hinderances to reopening local businesses.

Gillespie and Rep. Stephen Ross (R-Alamance) addressed the environmental effects of waterway debris removal, some of which were highlighted in a recent Vox article. Ray told members that back in May, NCEM halted work “for a couple of days” to remind Army Corps of Engineers and state subcontractors of best practices and state and federal requirements. He recognized the frustration from going slow to respect the vulnerable ecosystem.

Calabria told members that the state has received only about six percent ($3.6 billion) of the estimated $60 billion storm impact from the federal government, a much smaller share than other storms this century. The General Assembly has appropriated $2 billion, some of which should be eligible for federal reimbursement.

“At the end of the day the real measure is what we’ve done to impact lives in Western North Carolina.”

Rep. Karl Gillespie

Rep. Mark Pless (R- Haywood) asked why no homes have been rebuilt with $121 million provided by the state while waiting on federal funding. He asked particularly what had been done with $81 million spent already. Calabria said the $81 million is obligated but not yet spent for Horne to manage the program. This contract was a key topic in the May subcommittee hearing. Calabria added that the state had already received 800 applications, had begun site assessments for those homes, and had lined up general contractors to lead construction efforts since April 25, when the federal government approved the state’s action plan for a $1.4 billion disaster recovery grant.

Sen. Tim Moffitt (R-Henderson) added private roads and bridges to the list of concerns. Ray reported that 3,000 requests for unique projects have been submitted, and a consulting firm is conducting assessments. Moffitt emphasized that Helene has been the only storm to hit a mountainous area. He asked, “Do you get a sense that FEMA understands that this is not an easy task, that this is going to be several years in the making?” Ray replied, “I think they’re starting to.”

Gillespie reminded Ray and Calabria that amidst the shared frustration of the slow speed of working with the federal government toward recovery, the subcommittee expects results: “It’s incumbent on you gentleman to make sure that the folks in Western North Carolina are taken care of.”

He defined success in tangible progress, stating, “While I appreciate, very much, all of your efforts, at the end of the day the real measure is what we’ve done to impact lives in Western North Carolina. How many bridges are built back? How many fields are put back together? How many homes have been built?”

The Joint Legislative Commission on Governmental Operations Subcommittee on Hurricane Response and Recovery has called Emergency Management Director Will Ray and GROW NC Director Matt Calabria to testify Wednesday, July 30 at 9 a.m.

Members will question Ray about debris removal in Western North Carolina in the aftermath of Hurricane Helene and findings from a State Auditor’s report about salaries at a relief site. He is also expected to address Emergency Management’s preparedness for future storms. Calabria will be available to answer further questions about the recovery as needed.

This will be the subcommittee’s fourth hearing on Helene recovery.

“Helping Western North Carolina remains our top priority,” Co-Chair Karl Gillespie (R-Macon). “We’re looking for a progress report on how our people and our communities are rebuilding. We have to make sure everything is being done the right way.”